oklahoma auto sales tax rate

The Motor Vehicle Excise Tax on a new vehicle sale is 325. Oklahoma OK Sales Tax Rates by City The state sales tax rate in Oklahoma is 4500.

Which U S States Charge Property Taxes For Cars Mansion Global

609 rows 2022 List of Oklahoma Local Sales Tax Rates.

. How Much Is the Car Sales Tax in Oklahoma. With local taxes the total sales tax rate is between 4500 and 11500. 73501 73502 73505 73506 and 73507.

There are approximately 67909 people living in the Lawton area. Excise tax is often included in the price of the product. An example of an item that exempt from Oklahoma is.

Denotes Use Tax is due for sales in this city or county from out-of-state at the same rate as shown. In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer. For example here is how much you would.

Lowest sales tax 485 Highest sales tax 115 Oklahoma Sales Tax. This is the total of state county and city sales tax rates. Oklahoma charges two taxes for the purchase of new motor vehicles.

Average Sales Tax With Local. Counties and cities can charge an additional local sales tax of up to 65 for a. That must be added to the city tax and the State Tax.

States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125. The sales tax rate for the Sooner City is 45. Content updated daily for oklahoma sales tax rate.

Effective May 1 1990 the State of Oklahoma Tax Rate is 45. How do you calculate sales tax on a car. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price.

However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. The Motor Vehicle Excise Tax on a new vehicle sale is 325. 31 rows The state sales tax rate in Oklahoma is 4500.

This means that depending on your location within Oklahoma the total tax you pay can be significantly higher than the 45 state sales tax. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. The minimum combined 2022 sales tax rate for Woodward Oklahoma is.

Typically the tax is determined by. The state also has some special taxes and levies discretionary taxes local sales and. Oklahoma charges 45 percent state sales tax on sales of tangible personal property and certain services.

Used vehicles are taxed a flat fee of 20 on. The Oklahoma sales tax rate is currently. Excise tax is assessed upon each transfer of vehicle all terrain vehicle boat or outboard motor ownership unless specifically exempted.

This is also in addition to the State. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. To calculate the sales tax on your vehicle find the.

875 2022 Choctaw sales tax Exact tax amount may vary for different items Download all Oklahoma sales tax rates by zip code The Choctaw Oklahoma sales tax is 875 consisting. 125 sales tax and 325 excise tax for a total 45 tax rate. The Lawton Oklahoma sales tax rate of 9 applies to the following five zip codes.

The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. The normal sales tax in Oklahoma is 45 but all new vehicle sales are taxed at a.

Oklahoma Vehicle Registration And Title Information Vincheck Info

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Understanding California S Sales Tax

Owasso Oklahoma Business And Sales Tax Rates

Bob Moore Ford New And Used Dealer In Oklahoma City Ok

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

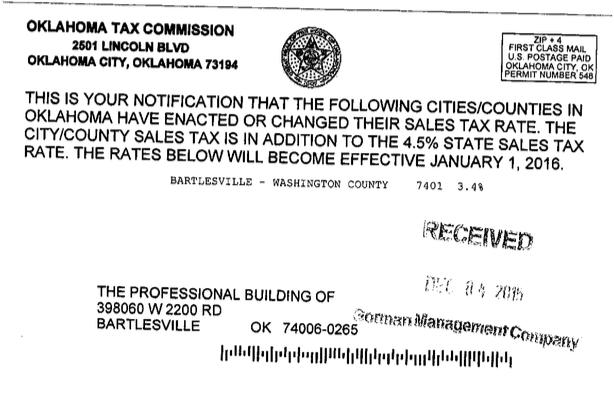

Otc Card Reflects City S Portion Of New Sales Tax Rate City Of Bartlesville

New Jeep Wrangler In Oklahoma City Bobhowardcjd Com

New York Sales Tax For Your Auto Dealership

Free Oklahoma Motor Vehicle Bill Of Sale Form Word Pdf Eforms

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

Nj Car Sales Tax Everything You Need To Know

Car Tax By State Usa Manual Car Sales Tax Calculator

Las Vegas Sales Tax Rate And Calculator 2021 Wise

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities